Why Uranium?

Why uranium has experienced a resurgence in demand.

6 minute read

As the world faces the dual challenges of rising energy demand and accelerating decarbonization goals, uranium has experienced a resurgence in demand. While many are familiar with its use in nuclear energy, the broader implications of uranium in clean energy transitions, technological revolutions like artificial intelligence (AI), and even emerging industries like hydrogen production often go overlooked. This has led to a gap in understanding of why uranium is not just a commodity, but a strategic resource with immense investment potential.

Here is why investing in uranium makes sense in today’s evolving market, including a breakdown of its journey from the ground to a tokenized asset.

The role of uranium in the energy transition #

As the world accelerates its shift away from fossil fuels, nuclear energy has become a key player in achieving carbon neutrality. Unlike intermittent renewable sources like wind and solar, nuclear power offers consistent, reliable, and low-carbon energy, making it indispensable for meeting global climate goals.

Countries like China, India, and the United States are expanding their nuclear infrastructure, while others are extending the life spans of existing reactors. These developments are driving sustained demand for uranium, particularly as nuclear energy is increasingly recognized as a scalable, reliable solution for reducing greenhouse gas emissions.

AI’s continued growth and energy requirements #

AI is driving a global transformation that is set to continue accelerating. However, its rapid adoption creates an unprecedented demand for electricity that, when coupled with ongoing pushes to transition to alternative energy sources, could futher increase the supply and demand deficit.

Nuclear power and AI #

- Energy-hungry systemsAI training and operations consume vast amounts of power. Data centers running AI infrastructure require scalable and consistent electricity, which nuclear power can provide.

- Reliable power sourceUnlike renewables, which can fluctuate with weather conditions, nuclear energy delivers the stability necessary to power AI operations around the clock.

- Small modular reactors (SMRs)Emerging nuclear technologies like SMRs are perfectly suited to power localized AI data centers, making uranium critical to sustaining the AI revolution.

The synergy between AI and nuclear energy is not one-sided—AI is also being used to optimize the efficiency and safety of nuclear power plants, enhancing their appeal as a long-term energy solution.

Limited uranium supply meets growing demand #

The uranium market is defined by limited supply and growing demand, creating an attractive opportunity for investors. Mining uranium is capital-intensive and highly regulated, while demand continues to rise as more nuclear reactors come online and countries stockpile uranium for energy security.

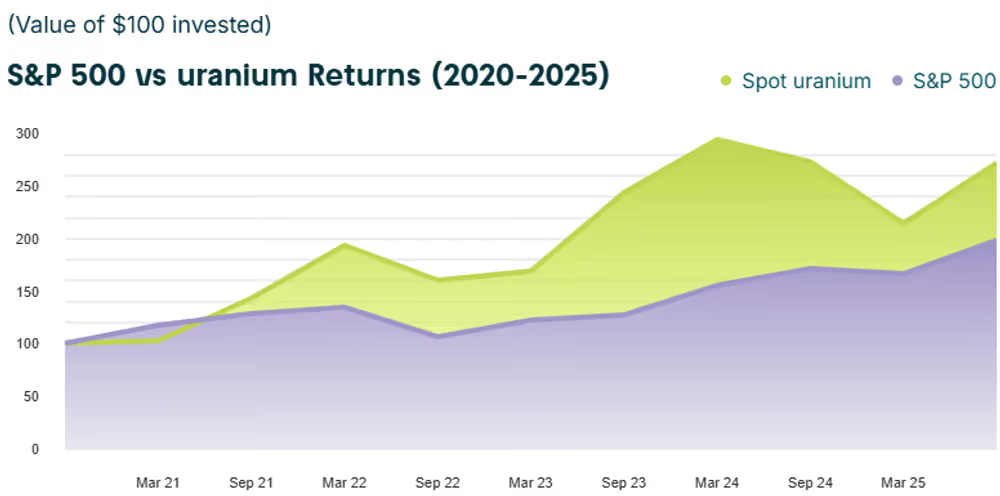

This dynamic is compounded by the slow pace of new mine development, which can take years to reach production. These supply constraints make uranium prices highly sensitive to demand shocks, offering significant upside potential for those who invest at the right time—reflected by uranium’s historic performance against investments like the S&P 500.

* since September 2020 until September 2025 (172.5% vs. 98.9%). Past performance is illustrative & is not a reliable indicator of future results. The graph is represented in USD, and the equivalent return in GBP may increase or decrease due to currency fluctuations.

Source: Nasdaq for S&P 500 and Numerco for Spot uranium.

Strategic importance beyond nuclear energy production #

Uranium is not just another commodity—it’s a strategic resource for nations aiming to secure long-term energy independence and sustainability. Beyond its role in energy production, uranium is a key resource in powering various emerging technologies.

Hydrogen productionAdvanced nuclear reactors powered by uranium generate the high temperatures needed to efficiently split water into hydrogen and oxygen, producing clean hydrogen with minimal emissions. This hydrogen is used in fuel cells to generate electricity for vehicles, buildings, and portable devices, producing only water as a byproduct.

Desalination initiativesNuclear reactors fueled by uranium provide the large, consistent energy supply required to power desalination processes, such as reverse osmosis and multi-stage flash distillation, which turn seawater into freshwater. These projects are particularly valuable in arid and water-scarce regions, where access to freshwater is critical for agriculture, drinking water, and industrial use

Commercial space projectsA growing number of private space technology companies are fuelling demand for uranium to provide solutions for long-lasting energy for spacecraft and satellites.

From mine to on-chain: The uranium tokenization process #

Uranium undergoes a complex journey from its discovery to the stage it becomes available for investment on the platform. Below are the key steps in this process:

1. Exploration and mining #

- ExplorationGeologists identify uranium deposits using advanced techniques such as aerial surveys, drilling, and geochemical analysis.

- MiningOnce a deposit is deemed viable, uranium ore is extracted through one of three methods: Open-pit mining, underground mining, or in-situ recovery (ISR).

2. Milling #

- The raw uranium ore is transported to a milling facility where it undergoes crushing and chemical processing to extract uranium.

- The resulting product is Uranium Oxide Concentrate (U3O8), also known as “yellowcake,” which is the standard form for uranium trading.

3. Refinement and conversion #

- At a conversion facility, the yellowcake is further refined and converted into a form suitable for nuclear reactors.

4. Transportation and storage #

- Uranium is securely transported to storage facilities or directly to nuclear plants.

- Regulatory oversight ensures safety and compliance during handling and storage

5. The Uranium.io tokenization process #

Once the uranium has been refined and allocated for trading, the tokenization process begins:

Asset registrationThe uranium asset (e.g., a stockpile of U3O8) is verified and registered on the Tezos blockchain, including its physical properties, storage location (regulated facilities operated by Cameco), and regulatory approvals.

Smart contract deploymentA smart contract is created to represent the uranium asset digitally on the blockchain. The contract defines ownership rights, transaction rules, and asset traceability.

Token mintingDigital tokens (xU3O8) are minted to represent fractional ownership of the uranium asset, making it accessible to investors. Each token is backed by a verifiable portion of the physical uranium.

6. On-chain platform #

The tokenized uranium is listed on the Uranium.io decentralized platform, where investors can buy, sell and trade.

Transactions are transparent and verifiable, aiming to ensure trust and liquidity in the uranium market.

Why the on-chain platform? #

It is revolutionizing the way people invest in uranium by leveraging blockchain technology to make it easier than ever to access this critical resource. Because the project is supported by uranium trading company Curzon Uranium, and Archax, the first registered crypto exchange in the UK, the marketplace has been designed with regulatory compliance as a key principle. By connecting investors with real-world uranium assets, it is opening up a dynamic, future-facing market for everyone to participate in.